This post will be updated from time to time to try to keep track of FHA/HUD news that apply to Buyers and Sellers.

In the meantime, here is link to press releases like the information below:

12-16-2014: Suspect FHA mortgage fraud? Call your nearest HUD office or the HUD Regional Inspector General, or call the HUD Hotline on 1 (800) 347-3735.

Monthly Insurance Premiums

In addition to an upfront mortgage insurance premium (UFMIP), you may also be charged a monthly mortgage insurance premium. You will pay the monthly premium for either:

(a) the first 11 years of the mortgage term, or the end of the mortgage term, whichever occurs first, if your mortgage had an original principal obligation (excluding financed UFMIP) with a loan-to-value (LTV) ratio of less than or equal to 90%;

or

(b) the first 30 years of the mortgage term, or the end of the mortgage term, whichever occurs first, for any mortgage involving an original principal obligation (excluding financed UFMIP) with an LTV greater than 90%.)

Source: http://portal.hud.gov/hudportal/documents/huddoc?id=92900-b.pdf

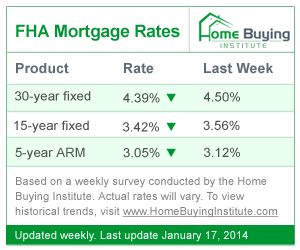

Here is the latest average FHA loan rate:

12-4-2014: HUD AND TREASURY ANNOUNCE ENHANCEMENTS TO HOUSING PROGRAM – Under the revised guidelines announced today, all homeowners in HAMP will now be eligible to earn $5,000 in the sixth year of their modification, which will reduce their outstanding principal balance by as much as $10,000. Homeowners will also be offered an opportunity to re-amortize the reduced mortgage balance, which will have the effect of lowering their monthly payment. As of today, approximately one million homeowners with HAMP modifications are eligible to earn the increased HAMP incentive. Source: http://portal.hud.gov/hudportal/HUD?src=/press/press_releases_media_advisories/2014/HUDNo_14-150

12-4-2014: Federal district court bars foreclosure sale of first lien HUD-insured mortgages. Federal law supersedes state law to protect losses at HUD and US taxpayers. Source: www.mpamag.com/real-estate/federal-district-court-bars-foreclosure-sale-of-first-lien-hudinsured-mortgages-20468.aspx<

10-22-2013: FHA delays ban on dual agency (i.e., both buyer and seller represented by the same broker) that was to take effect 10-1-2013. Source: http://norman-spencer.com/news/specialty/hud-to-delay-dual-agency-ban-for-real-estate-agents-514931

10-10-2013: Between 1997 and 2007, HUD’s loose lending practices for “affordable housing” created a bubble to deflate 30-40% of home prices? Source: WSJ, Opinion 9-18-2013, page A17.

10-8-2013: FHA may borrow $1 Billion from the US Treasury (FHA doesn’t need to ask for (my words – their $16B) “direct” taxpayer bailout – yet – since it can tap the US Treasury for financial assistance). Source: WSJ, 9-26-2013, A6.

9-14-2013: FHA to cut waiting time after foreclosure/short sale to 12 months under certain criteria (that as of the date of this update hasn’t been disseminated to many lenders)…But will lenders comply as they try to resell these loans to investors…hold the loans to season them…or just not make them…?Stay tuned! Source: http://www.macon.com/2013/09/12/2659718/fha-cuts-waiting-time-for-foreclosed.html

3-13-2013: FHA will need a bailout, but depends on what President Obama asks for in his March 2013 budget…if he releases it.

12-25-2012: Since HUD is expected to be underwater by $16.3 Billion, can these changes be brewing?: HUD raising minimum FHA loan score from 580 to 620? Or eliminating the HECM Reverse Mortgage Program? It’s a possibility… Source: http://www.inman.com/buyers-sellers/columnists/kenharney/talk-big-changes-fha-may-be-just-now

Much more information can be obtained from this HUD website:

HUD Press Releases.

12-3-2012: FHA has extended its waiver throughout all of 2013 allowing investors to sell flipped properties within the currently prohibited 90 day period after they purchased and possibly renovated the property. FHA extends 90 day flipping waiver.